Build Financial Model by Startups to attract the investors

November 8, 2023

In the dynamic world of business-to-business (B2B) startups, securing funding from investors is often a critical step toward achieving growth and success. To effectively attract investors, startups need to present a compelling financial model that outlines their revenue potential, cost structure, and path to profitability.

Most businesses especially Startups fail to present the data in proper format and visualisation which leads to a lack of information to the investors where REJECTION might triggered.

So here would like to share a glance at "Build Your STARTUP'S Financial Model to Grab Investors' Interest"

Your startup's financial model is one of the most important tools that have to grab investors' interest. It shows them how the business will generate revenue, cover costs, and become profitable. It also helps them to identify and mitigate potential risks.

Here are a few tips for building a financial model that will impress investors:

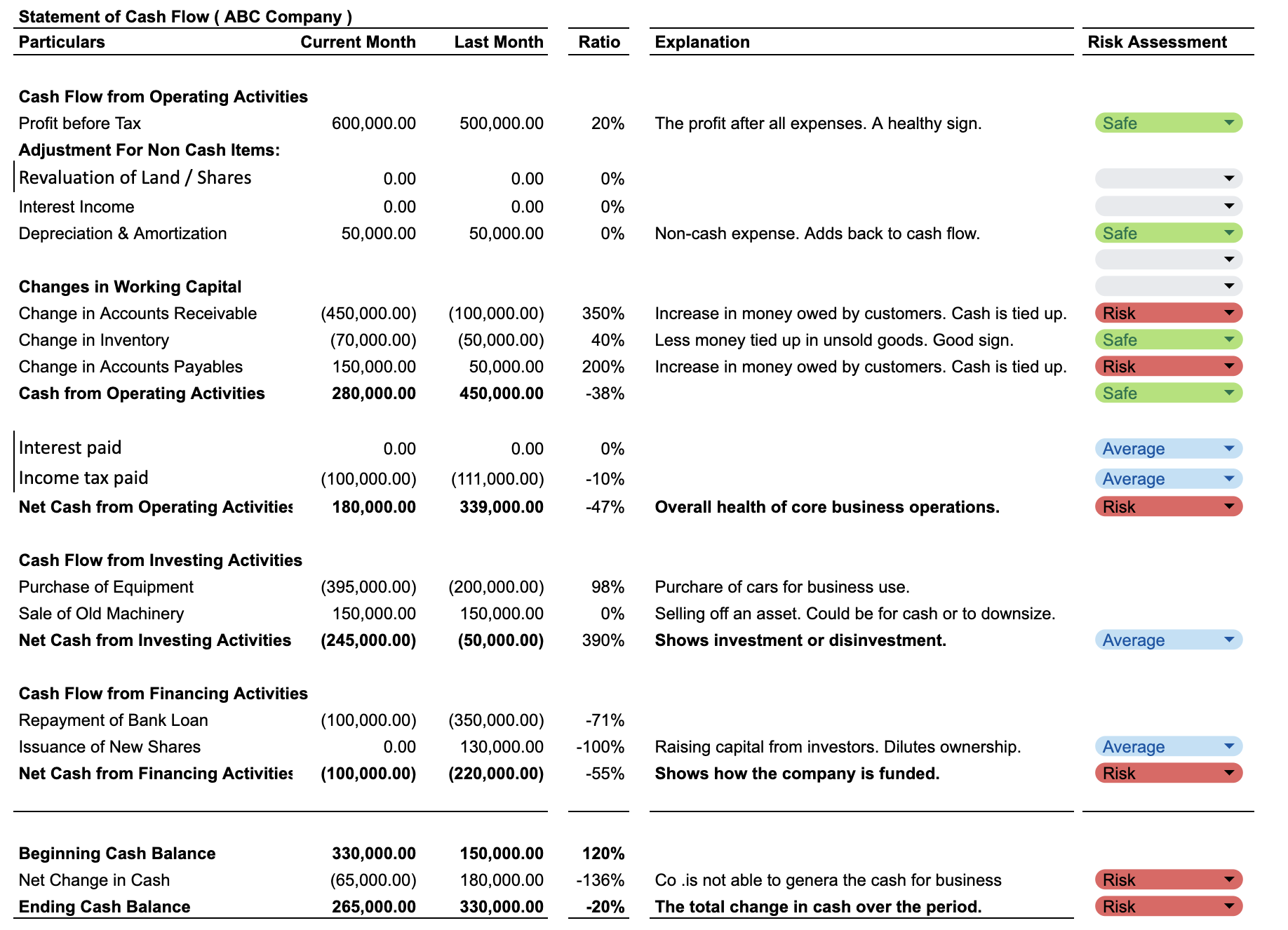

3 Statement Financial Modelling

- Clear breakdowns of Clientele and Revenue Sources

- Clearly segment your clientele. Understand who your customers are, their needs, and their buying behavior. Segment your customers into groups based on factors such as demographics, industry, or purchase history. This will allow you to better understand your target market and develop targeted marketing and sales strategies.

- Identify the revenue streams generated from each segment. Once you have segmented your clientele, identify the revenue streams generated from each segment. This will help you to understand how much revenue you are generating from each segment and which segments are most profitable.

- Analyze revenue trends. Track revenue trends over time to identify any growth or decline in revenue from each segment. This will help you to identify areas for improvement and make informed decisions about your marketing and sales strategies.

- Use the insights you gain to develop targeted marketing and sales strategies. By understanding your clientele and revenue sources, you can develop targeted marketing and sales strategies that are more likely to be successful.

- Use clear and concise language. Avoid using jargon or complex financial terms. Your financial model should be easy for investors to understand, even if they don't have a background in finance.

3. Details your key Imputs and metrics. Investors want to see how your business will perform over time. Highlight your key metrics, such as revenue growth, profitability, and market share.

4. Sensitive Analysis. Run different scenarios to see how your financial model performs under different conditions. This will help you to identify potential risks and develop strategies to mitigate them.

By following these tips, anyone can build a financial model that will be highly likely to grab investors' attention and help to raise the funding need to grow the startup.